Hong Kong ——

The global free-trade portHedgingX ——

The harbor to manage your Forex riskReal-time price

HedgingX products

As an active player in the global market, while you enjoy the abundant returns from the global trading, your asset is also affected by the changing forex rate. To better protect our clients’ fund, HedgingX offers products according to different risk and investment time horizon preferences.

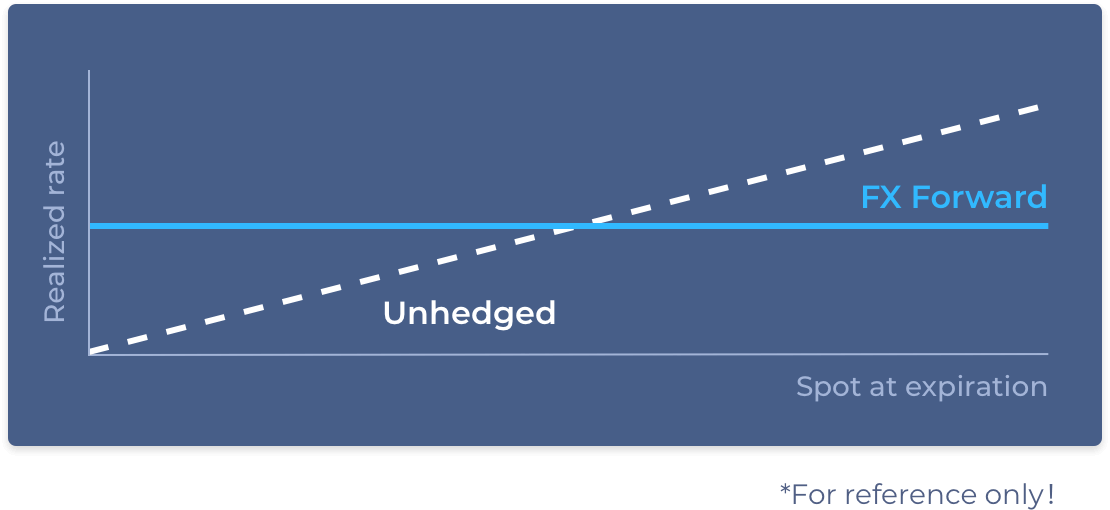

FX Forward

FX Forward is a foreign exchange derivative in which the client deposit a certain amount of margin and delivers the foreign exchange on a certain date (more than two business days after the deal date) in the future according to the foreign exchange currency, amount and exchange rate agreed with PingPong Intelligence.

Example1:

A cross-border online retail seller receives Euro every day but needs Chinese Yuan to pay his vendors. The client was worried about the fluctuations of EURCNH rate so she entered into a forward contract with PingPong Intelligence at the beginning of 2020 with the rate of 7.9424 for 6 months. With the rate fixed at 7.9424, the client was able to convert his Euros at a better rate than the fist half year’s average, which is 7.7616.

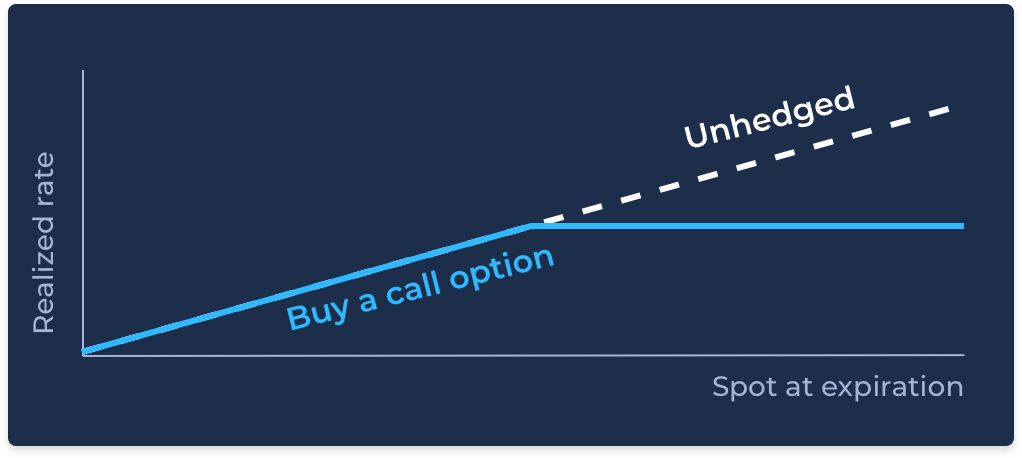

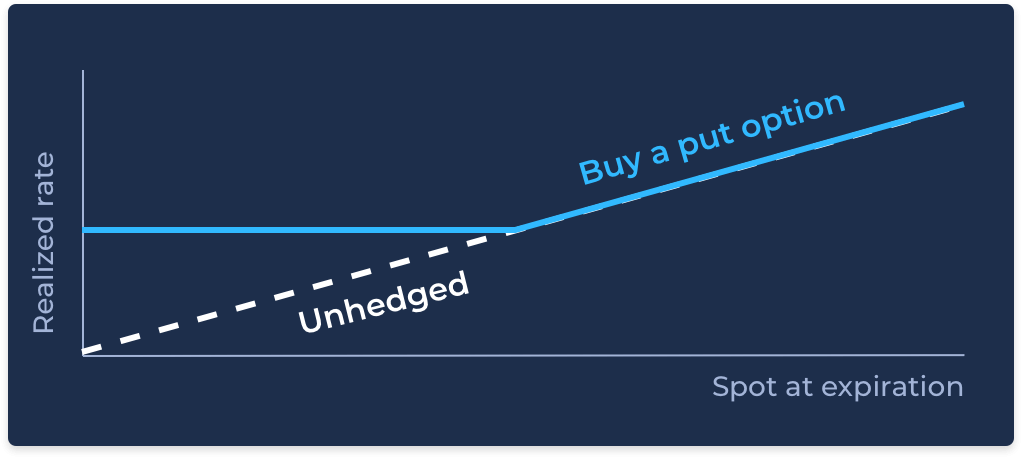

FX Option

FX option is a foreign exchange derivative in which one party has the right to exchange a certain volume of one currency to another at a pre-agreed exchange rate on a given trading day. The option buyer acquires such right by paying an option premium while the option seller collects the option premium and performs its obligation when the buyer chooses to exercise its right (vanilla European options).