Fee Structure

- We charge no commission on your Forex trades

- There is neither account opening fee, nor any hidden cost

- All bid and ask prices are systematically selected best available prices sourced from our highly reputable liquidity providers without human intervention.

Spread

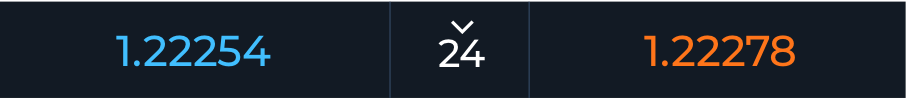

Bid-Ask Spread refers to the difference between the buy and sell prices quoted for a forex pair.

It represents the cost of trading FX at HedgingX.

The number 24 in the below example means the spread is 2.4 pips.

The spread may fluctuate from time to time due to volatility and liquidity.

See All Live Spreads >

Rollover

Forex trading usually involves leverage trading, but investors do not need to pay interest. Instead, if the investor keeps holding position overnight before the settlement day, it will have to be rolled over. The rollover rate is the difference between the overnight interest rates of the two currencies and can be negative or positive.

Currencies are traded in pairs. Buying one currency means selling another currency simultaneously. If the interest rate is higher on the currency you bought than the interest rate on the currency you sold. You are earning the rollover rate. On the other side, the client is paying the rollover rate if the interest rate is lower on the currency he/she bought than the interest rate on the currency he/she sold.

For HedgingX trades, the daily rollover time is dictated by the earlier of the two currencies’ cutoff time. For example, the rollover time for JPY/CNY is 09:30 am because the same-day settlement deadline for JPY is earlier than the CNY. By default, if a client failed to settle the trades on the value date, HedgingX will roll the trades to the next business day. Or a client can also choose to roll the open positions to any future business date manually before such currency’s cutoff.

See Forex Rollover Rate >